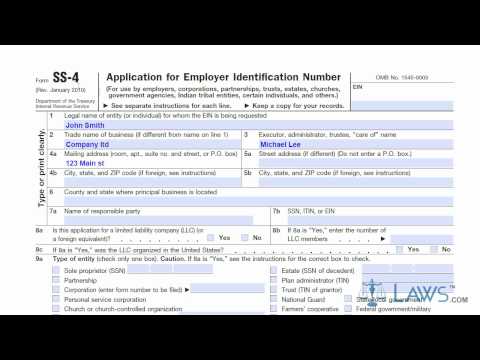

Laws calm legal forms guide the SS-4 form is a United States Internal Revenue Service tax form used to apply for an employer identification number or EIN. An EIN is used as the corporate identification number for taxation purposes, similar to a Social Security number for an individual taxpayer. The SS-4 form can be obtained through the IRS's website or by obtaining the documents through a local tax office. The form is to be filled out upon the creation of a new entity, which can be a corporation, partnership, trust, estate, church, government agency, certain individuals, or other taxable entities. The first step is to fill out all general information required on lines 1 through 7. On line 1, put the legal name of the entity for which the EIN is to be given. If the trade name is different than the legal name, provide the trade name on line 2. If the EIN is for a trust or estate, provide the administrator or trustee name on line 3. Enter all applicable mailing and business addresses in lines 4 through 6. The responsible party who will answer for the entity must be listed on line 7 with their Social Security number. On lines 8 through 9, state the type of entity applying for the EIN, identify the corporate status if any, or if the entity is a trust, estate, nonprofit, or other entity required to have an EIN. If the entity is a corporation, write the place of incorporation on line 9b. Select the reason for using the SS-4 form on line 10. You must choose if it is a new business, changed business, or creation of another type that requires an EIN. You must further detail your business on lines 11 through 17. You must indicate the date the entity was created,...

Award-winning PDF software

56 probate Form: What You Should Know

What Happens If I Don't File Form 56, Notice Concerning Fiduciary Relationship, on Time? If a fiduciary agreement includes a right in the executor or administrator to receive a lump sum without repayment, then the executor or administrator can't avoid the Form 56 requirement. For details on that, have a look at What happens to a lump sum if the executor doesn't file Form 56? — California Law Filing Form 56, Notice Concerning Fiduciary Relationship— IRS The Notice of Fiduciary Relationship is due on or before the last day of the calendar month following the earliest of (a) the date of death of the decedent or (b) the date that the executor, administrator, guardian or conservator is authorized by law to receive a lump sum without payment. Filing Form 56, Notice Concerning Fiduciary Relationship— Federal Tax For the deceased to be treated as personally liable, the notice must be filed within 15 days following the date of death. Filing Form 56, Notice Concerning Fiduciary Relationship— California Tax The Notice of Fiduciary Relationship is due on or before the last day of the calendar month following the earliest of (a) the date of death of the decedent or (b) the date that the executor, administrator, guardian or conservator is authorized by law to receive a lump sum without payment. Form 56, Notice Concerning Fiduciary Relationship— Business/Profession If you are a professional that is required to file a Certificate of Divorce, then this notice is due 30 days or more before the expiration of a court-ordered period of separation. If you are a personal representative (who is authorized by law to receive a lump sum without payment), the Notice of Fiduciary Relationship is due 30 days or more before the expiration of a court-ordered period of separation.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 56, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 56 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 56 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 56 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 56 probate