Hello again everyone and welcome back to programming in Access 2013, my name is Steve Bishop, and today we're going to be doing another video on a login screen. Unlike my first video, we're not going to be using a combo box because if you recall in that other video we stored our usernames and passwords in a combo box and then compared what the user typed in for the password to what was stored in the combo box but in this particular case we're going to do a much more traditional login screen where the user needs to type in both the username and the password in order to gain entry into the database. All right, we're also going to do a little of validation here too so let's just go ahead and get started. I'm going to go into my database here, and I've got of course my table 1 employees table that has a password and username I've renamed the old login form I've added the old and in parentheses when I renamed it. That just is a good idea to hold on and keep your old forms around just in case there may be some code in there that you want to copy or retrieve or maybe the user or customers have said, “You know, I kind of like the way that old form used to look. Can you go back to that old form?” Well, it's nice to go ahead and keep that information around so that you can easily get back into it and recreate it, so that's just a good idea to go ahead and just rename it you know eventually after you know so long that it's pretty clear that that form won't be used anymore. Then, go ahead and delete it....

Award-winning PDF software

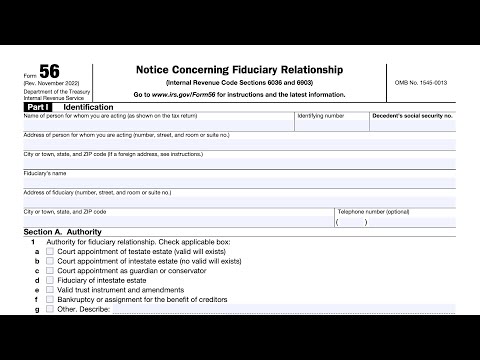

How to prepare Form 56

About Form 56

I do not have personal opinions or knowledge, but I can provide you with information. Form 56 is a form used by the Internal Revenue Service (IRS) to authorize an agent to act on behalf of a taxpayer and to receive sensitive information about the taxpayer from the IRS. This is known as a Fiduciary Relationship Declaration. The purpose of this form is to ensure that the person authorized to act on behalf of the taxpayer is properly identified and has been given the legal authority to do so. Form 56 is typically required in several situations, including: 1. When someone is acting as a fiduciary for someone else's estate or trust. 2. When someone is acting as a representative for a taxpayer who is unable to act on their own behalf, such as a parent who is proxy for a minor child. 3. When a taxpayer is being represented by a Power of Attorney. If you have any questions about whether or not you need to complete Form 56, you should consult with a legal or tax professional.

What Is Irs Form 56?

The user should fill out Form 56 when the owner of the trust or estate changes. Thus, the individual needs to inform the Internal Revenue Service about the transition of owners rights from one person to the other. Applicants have to send an additional copy of the document to the individual or organization they work with. Basically, the PDF template consists of two sheets. It contains the personal and contact details of an applicant like a name, address, and TIN. Also, it’s required to prthe information about the entity the person works with. Each trust’s fiduciary provides separate template individually. Prepare all necessary identifying papers to fasten the process of sample completion.

Fill Out The 56 Form Online in a Few Minutes

Open the blank by clicking at “Start Now” button. Then, the page with an editable Form 56 opens. Follow the simple instructions given below:

- The document starts with an identification data. Pryour personal and contact details together with postal address and identifying number of the person you are acting from. If you act from an individual, insert the social security number, if not, then type in the employee identification number.

- The next part of the blank contains detailed reasons of liability and tax notices the user needs to specify. They specialize the sum of federal tax sample has used. Include the tax periods or years your authority did not cover as well.

- The second part of the document contains the application for the partial or total revocation or termination. It consists of three parts to specify the revocation and its details.

- Next, the customer infills court and administrative proceedings like the name and address of the court and proceeding information.

- Finally, add the digital certification signature. Draw it with a touchpad or mouse or type in your initials using the keyboard.

- Save all changes and download a template to your computer. Print it on paper or send electronic Form 56 Pdf blank via e-mail.

With recommendations given above every user submits the sample faster than ever before.

Online systems help you to organize your document management and increase the efficiency of your respective workflow. Go along with the short help in order to carry out Irs Form 56, keep clear of problems and furnish it inside of a well timed manner:

How to accomplish a Form 56 on line:

- On the web site while using the sort, simply click Start off Now and go to your editor.

- Use the clues to fill out the related fields.

- Include your own details and make contact with facts.

- Make positive you enter accurate material and figures in applicable fields.

- Carefully test the information of your form at the same time as grammar and spelling.

- Refer to help you segment when you've got any doubts or address our Aid staff.

- Put an digital signature in your Form 56 together with the guidance of Indication Instrument.

- Once the form is done, press Performed.

- Distribute the completely ready variety via email or fax, print it out or preserve on your device.

PDF editor makes it possible for you to make alterations with your Form 56 from any internet linked unit, personalize it according to your needs, sign it electronically and distribute in several approaches.

What people say about us

The best way to submit forms without mistakes

Video instructions and help with filling out and completing Form 56